Automated, online loan origination

Workflow-based loan origination platform for supporting front- and back office processes, with reference model

From the loan offer to the disbursement

Making a loan offer at a personal meeting with the Client, based on their requirements and background information and on the basis of the Client contracts.

Online recording of data required for loan application, uploading documents immediately after the credit approval.

Pre-qualification, review steps, definition of documents to be submitted, application of approval rules are automated, driven by workflow-engine, and built on professional processes of credit institutions.

Transparent presentation of actual status of loan application.

Online support of loan contract phase.

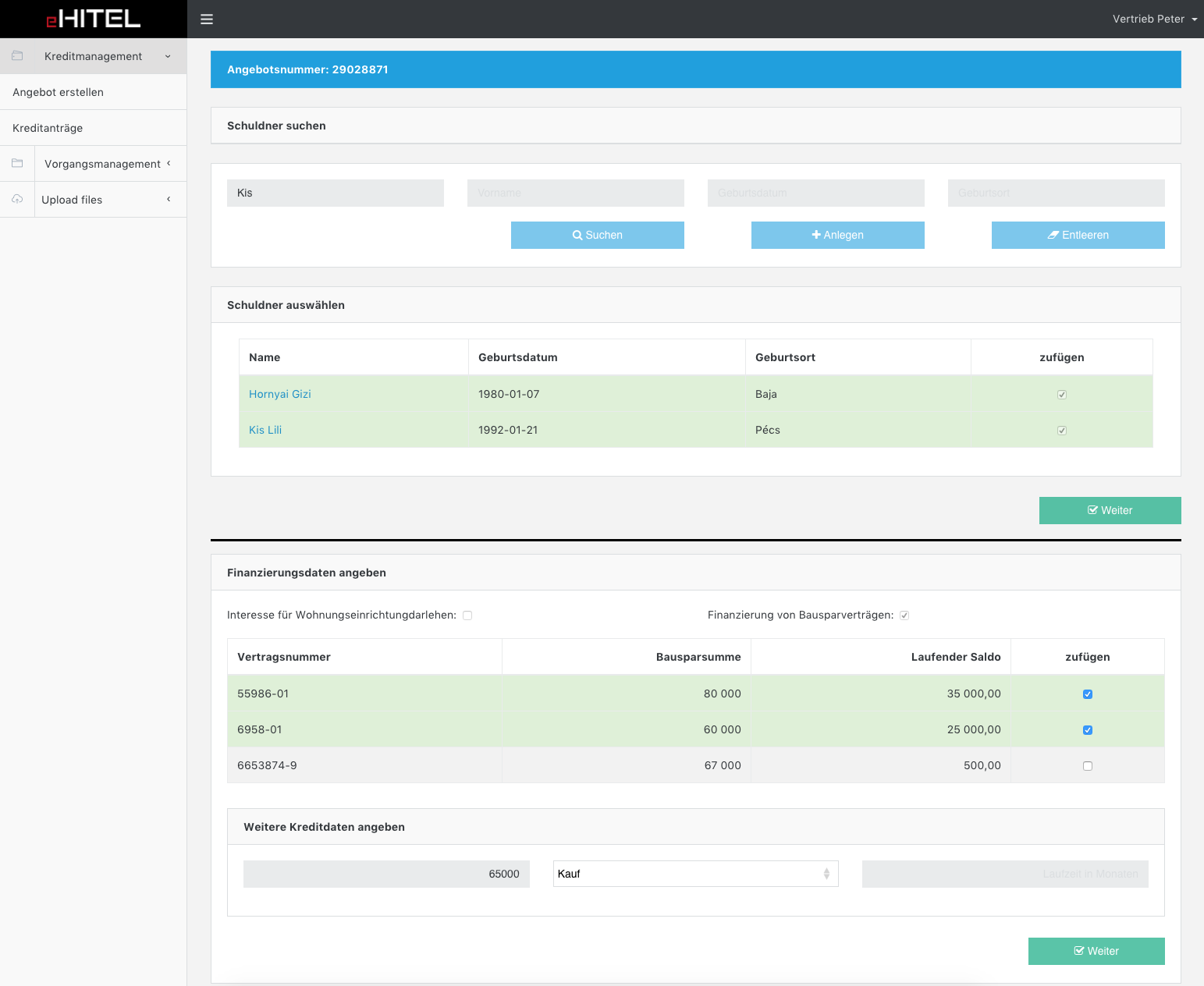

Making a loan offer

Credit offers can be made for existing customers, customer groups or even those who are not yet with the bank. In the case of existing Clients, the loan offer is made by evaluating the Client's bank background information and contracts, taking into consideration the conditions of the prevailing bank loan-constructions.

The personal information and bank-related data required are retrieved from core banking applications. The evaluation of the data and the preparation of the offer are carried out in accordance with the rules set out in the DMN decision tables, which ensures sufficient flexibility and transparency in the case of modification of banking products.

The entire process model of making a loan offer is created according to the BPMN standard, and real-time execution of process instances is controlled by a workflow engine. In the loan offer and acceptance process, we have defined waiting states to ensure the arbitrary division of the process.

Loan application

Recording data and uploading documents are necessary for the judgement of a housing loan, for example adding credit participants, recording data of income and expenditure, housing information, guarantee and real estate are carried out in the loan application phase.

The loan application process is less structured than the loan offer phase. Therefore, we combine the benefits of Case Management (CMMN) with BPMN.

Through our application, the electronic documents for credit approval can be uploaded to the central document management system.

The rules set out in the decision tables ensure the loan application can be accepted only if all data is fully recorded.

In the loan application phase, personal agents can make the pre-scoring, on the basis of determining whether the compiled loan application package is expected to receive positive consideration.

Recorded data is also made available for core banking applications.

Credit approval - Loan contract

The credit approval is supported by the application through the technical implementation of the decision workflow. The number of judgment levels and process steps are defined by the process model. The credit approval competencies and other influencing factors, criteria (e.g. credit approval loads) are controlled through decision tables.

Both the personal agent and client can be informed on-line through the system of the qualification status of the prepared loan application.

At the contracting stage, the application starts the process of preparing the housing loan and additional contracts. The data needed to upload document templates is collected and forwarded by the eHitel application to DMS systems that impersonate the contract templates.

The created documents will be returned to the eHitel application from the DMS systems, so they will also be available online to the personal agent and client.

Disbursement

The application manages the payment terms defined in the credit approval, providing a platform for submission of the required documents and for electronic uploading.

In the case of close submission deadlines or of a failure to comply with the time limit, the credit adviser or, on demand, the borrower directly will be informed of the necessary action.

After completing the payment conditions, the actual payment process is started calls service providers of payment systems where payment transactions are realised.

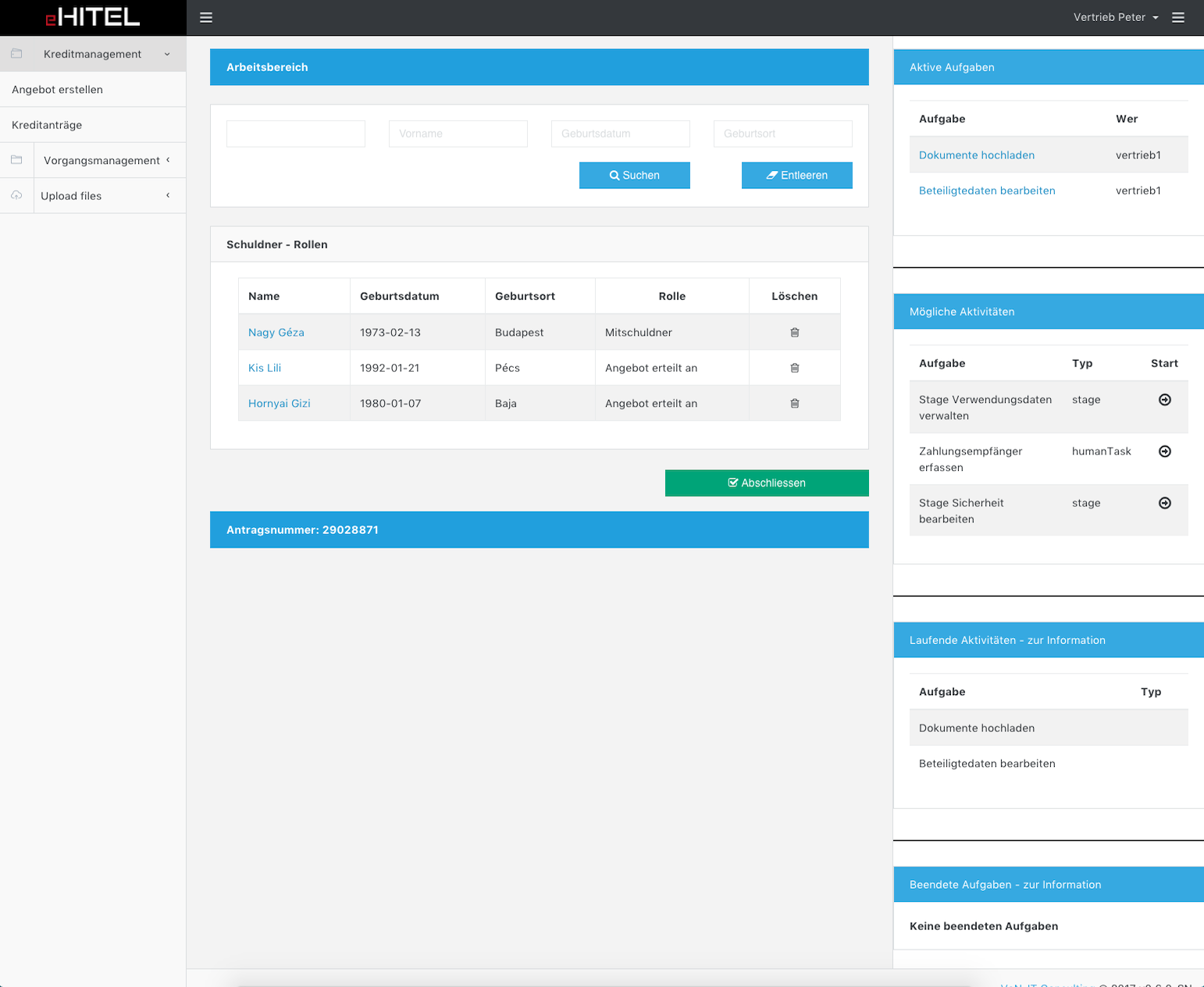

Task management

The application both guides and supports the personal agent through the necessary steps for the loan application to be accepted. Each task is assigned according to the lending model of the financial institution.

The personal agent can see the tasks in their own task list in context; which loan case is in which phase and what steps and tasks are needed to be completed.

The used process model provides sufficient flexibility in the loan application phase, so it is feasible to manage cases with the specificity of the particular case.

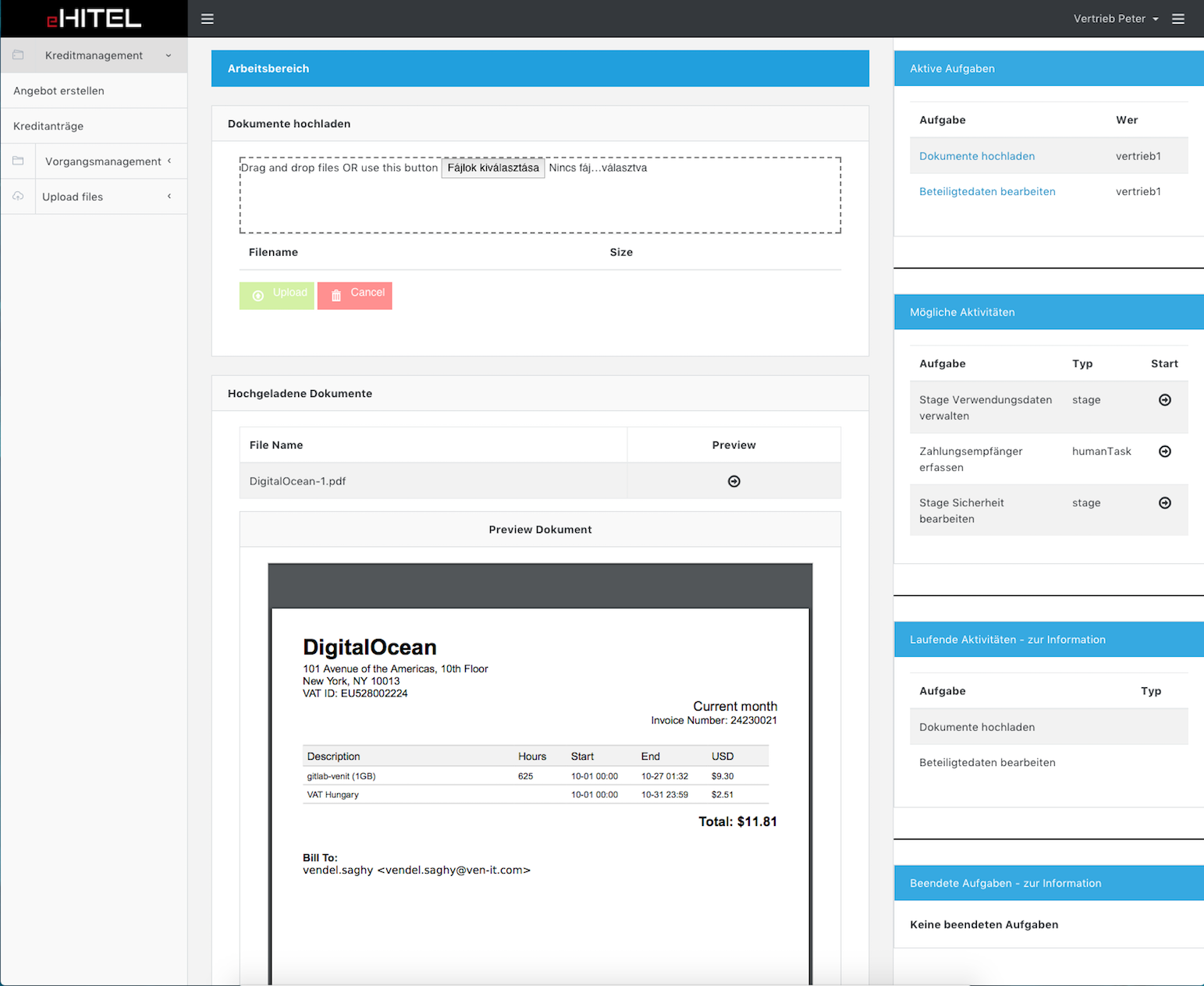

Document management

The application provides an interface for the electronic upload of documents to be submitted during the loan origination process.

It examines whether all the document types specified in the credit institution codes have been submitted and in case of a shortfall it warns the personal agent about the incomplete loan application package.

It provides integration with the credit institution's existing document management system e.g. by CMIS standard.

Gaining many benefits from a business and IT perspective

Quality improvement

Shorter credit approval processes, more satisfied Client

Nowadays, long lead times are still among the biggest problems with the lending process. However, with process optimisation and automation of the processes of loan application, credit approval and loan contracts can be significantly accelerated. The client does not have to spend unnecessary time searching and filling forms. Through their personal account, the Client can easily check the status of its credit transaction in the application.

Cost-effectiveness

Automated processes, less administration

Highly automated processes require less administration capacity with shorter lead-times, which enables significant cost-saving to be achieved.

Each task becomes clear to everyone, data is centrally available.

Agility

Flexible customising

Required modifications in the business processes, in decision rules, due to the legal regulatory environment and changes of credit products, can be implemented flexibly at any time. Most of the modifications made by business analyst and process managers can be implemented on the graphical UI of process modelling platform with parameters.

The same business language

Business-IT Alignment

eHitel application is the result of planning and development being based on business definition that is easily interpretable by professions and IT. There is a direct link between professional process models, decision tables and real-time software. The loan profession, the process management and the IT speak the same language.

Easy to integration

Built-in interfaces

eHitel is able to work with other systems (e.g. core-banking applications, CRM systems, document management systems, ESB) thanks to built-in standard interfaces.

KP indicators

Easy to measure, transparency

The eHitel system makes it easy to measure lead times, process heat-mappings, track status of tasks, and regularly evaluate process progress. This toolkit ensures the transparency of lending processes and provides an opportunity to improve the efficiency of lending processes.

Please contact us for a personal product presentation!

Blog

ven-it team blogContact us

VeN-IT Consulting Kft.

1112 Budapest

Horzsakő utca 5.

Tel.: +36 1 781 0378

E-mail: infokukacven-it.com